AARP Eye Center

Medicare Part D Spending on Top Brand Name Drugs Greatly Exceeds the Costs Associated with Drug Development

By Leigh Purvis, May 10, 2022 09:59 AM

In the late 1980s, the first FDA-approved HIV/AIDS drug entered the market with a price of $10,000 per year, the highest price ever set for a new drug. In 2021, the most expensive prescription drug in the U.S. cost more than $86,000 per month. High launch prices are also just the beginning, as many brand name drug companies raise their prices at rates that exceed inflation every year that their products are on the market.

Congress is currently considering proposals that will help address the challenges created by high and growing drug prices. The drug industry has strongly criticized these efforts, arguing that high prices are needed to pay for the costs associated with research and development.

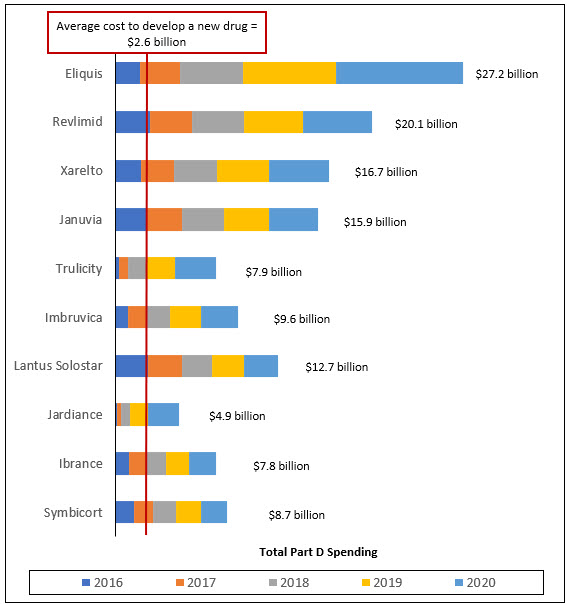

However, based on Medicare Part D spending alone, top brand name drugs often recouped the average cost to develop a new drug many times over between 2016 and 2020.

Medicare Part D Spending on Ten Brand Name Drugs Exceeds $130 Billion Over 5 Years

AARP’s Public Policy Institute examined total Medicare Part D spending between 2016 and 2020 for the 10 brand name drugs with the highest total Medicare Part D spending in 2020.* We then compared total Medicare Part D spending over the five-year period to the drug industry’s estimate that it costs an average of $2.6 billion to develop a new drug, which includes the costs associated with drugs that fail to reach the market.

All of the top Part D drugs had total Medicare Part D spending that exceeded the average cost of drug development ($2.6 billion) over the study period. Seven of the 10 top drugs had total Medicare Part D spending that exceeded the average cost of drug development in a single year (2020).

Eliquis, a prescription drug used to treat atrial fibrillation, had total Part D spending of $27.2 billion between 2016 and 2020. This amount is more than ten times the average cost to develop a new drug. Three other top brand name drugs had total Part D spending that was more than six times higher than the average cost to develop a new drug over the same time period.

On average, total Part D spending on the top 10 drugs over the five-year period was more than five times higher than the average cost to develop a new drug.

Overall, the 10 brand name drugs in this study represented $131.5 billion in total Medicare Part D spending between 2016 and 2020.

Source: AARP Public Policy Institute analysis of 2016–2020 data from the Centers for Medicare & Medicaid Services, Medicare Part D Drug Spending Dashboard.

Notably, this analysis only includes Medicare Part D spending; global spending on the top 10 brand name drugs is considerably higher. Further, based on their original FDA approval dates, the top 10 brand name drugs have a minimum of one and maximum of eleven years of additional spending that are not captured in this analysis.

In addition, the drug industry’s estimate that it costs $2.6 billion to develop a new drug has been subject to substantial criticism, and other researchers have estimated that drug development costs are considerably lower. Thus, this analysis may provide an underestimate of total Medicare Part D spending that exceeds the average cost of drug development.

Conclusion

Surveys show that roughly one in four Americans find it difficult to afford their prescribed medications, and the vast majority of voters view addressing high prescription drug prices as a top priority. At the same time, they want to continue to benefit from new prescription drugs that help improve lives.

The drug industry has capitalized on the latter concern, arguing that research and development will slow if it cannot continue its current pricing practices. However, this analysis indicates that the revenue generated by just one taxpayer-funded program over a relatively short time frame still greatly exceeds the average cost to develop a new drug.** It is also notable that a recent congressional investigation found that leading drug companies spend more on stock buybacks and dividends than on research and development.

High and growing prescription drug prices will eventually affect all Americans in some way. Congress is currently considering proposals that will permit Medicare to negotiate with drug companies, as well as discourage price increases that exceed inflation. Rather than cause harm, experts say that proposals like Medicare negotiation will help encourage the drug industry to focus on products that offer meaningful value to patients. Equally important, such changes would help curtail some of the drug industry’s more controversial pricing practices and provide all Americans with much-needed financial relief.

* This analysis did not include the brand name drug with the 9th highest total Medicare Part D spending in 2020 (Humira (Cf) Pen, used to treat rheumatoid arthritis and plaque psoriasis) since it was not on the market for the full study period (i.e., 2016 through 2020). The product was replaced with Symbicort, used to treat asthma and COPD, which had the 11th highest total Medicare Part D spending in 2020.

** This analysis does not account for proprietary drug company rebates and other price concessions. Research indicates that only about one-third of brand-name drugs have more than nominal rebates and that there is substantial drug-to-drug variability. However, even if we assume a rebate of 35 percent, combined total Medicare Part D spending between 2016 and 2020 would still exceed the average cost of drug development for all of the top brand name drugs in the analysis.