8 Top-Performing Large-Blend ETFs

ETF offerings from iShares and Vanguard stand out.

Large-blend stock funds are among the most important building blocks for a diversified portfolio. Investors have increasingly turned to passively managed S&P 500 funds when putting money to work in large-blend investments, and the shift has paid off.

S&P 500 ETFs have ranked among the best performers in the large-blend category over the last one-, three-, and five-year periods. Over the last 12 months, large-blend funds are up an average of 17.4%, compared to a 20.5% gain in the U.S. stock market as measured by the Morningstar US Market Index. Over three years, the category outperformed the market by 0.3 percentage points per year.

Among the top performers in the category, ETF offerings from iShares and Vanguard stand out, thanks to their heavy exposure to rallies in mega-cap stocks and low fees.

- Invesco S&P 500 Quality ETF SPHQ

- iShares Core S&P 500 ETF IVV

- iShares MSCI KLD 400 Social ETF DSI

- iShares MSCI USA Quality Factor ETF QUAL

- SPDR Portfolio S&P 500 ETF SPLG

- SPDR S&P 500 ETF Trust SPY

- Vanguard Mega Cap ETF MGC

- Vanguard S&P 500 ETF VOO

Large Blend Funds vs. the U.S. Stock Market

What Are Large-Blend Funds?

Large-blend funds stocks are considered fair representations of the U.S. stock market. These are portfolios that are defined as having neither a growth nor a value focus, and which invest across the spectrum of U.S. industries. Due to their broad exposure, large blend funds often perform similarly to the S&P 500 Index.

Screening for the Top-Performing Large-Blend ETFs

To screen for the best-performing ETFs in this category, we looked for those that have posted the top returns across multiple periods.

We first screened for the ETFs that ranked in the top 33% of the category over the past one-, three-, and five-year time frames. Then we filtered for the ones with Morningstar Medalist Ratings of Gold, Silver, or Bronze. We also excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Medalist Ratings.

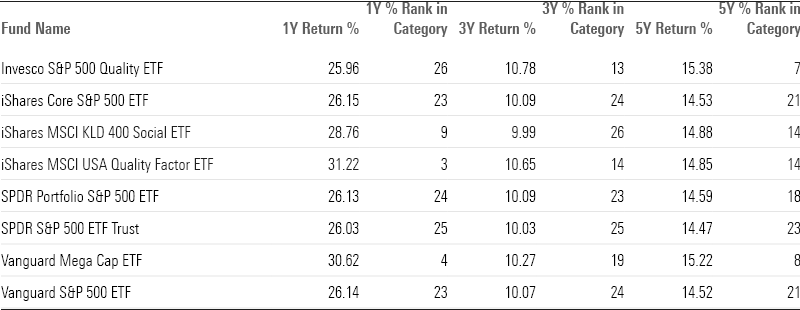

From this screen, we’ve highlighted the eight ETFs with the best one-year performance. This group consists only of index funds.

Top-Performing Large-Blend ETFs

Invesco S&P 500 Quality ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Invesco S&P 500 Quality ETF builds a portfolio of profitable industry leaders with solid balance sheets. High-quality companies won’t always be in favor, but targeting leaders while charging a low fee should help it outperform the Russell 1000 Index over the long haul.

“The fund tracks the S&P 500 Quality Index, which sweeps in high-quality stocks from the S&P 500. S&P’s quality score favors stable, profitable companies over those that rely on debt financing or aggressively grow their assets. The index ranks all S&P 500 constituents by quality score and picks the highest-ranking 100. It weights selected holdings by the product of their market cap and their quality score, steering the portfolio even further toward quality while also tying weights to market prices.”

—Bryan Armour, director

iShares Core S&P 500 ETF

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

“IShares Core S&P 500 ETF combines a broadly diversified portfolio of U.S. large-cap stocks with low turnover and a minuscule price. The strategy replicates the flagship S&P 500, which is a market-cap weighted basket of about 500 of the largest U.S. stocks. Over the past 10 years through December 2022, the fund has outperformed its average category peer by 1.93 percentage points. The fund should continue to outperform in the long run.”

—Mo’ath Almahasneh, associate analyst

iShares MSCI KLD 400 Social ETF

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“IShares MSCI KLD 400 Social ETF selects stocks based on their environmental, social, and governance attributes. The MSCI KLD 400 Social Index, which this fund fully replicates, weaves a market-cap-weighted 400-stock portfolio that targets the companies from each sector with the best ESG traits. MSCI grades firms’ ESG merit based on their exposure to relevant industry risks and opportunities, fitness to manage the risks and seize the opportunities, involvement in controversies, business involvement, and corporate governance.

“This fund climbed 9.1% annually from its November 2006 inception through November 2023, trouncing the average large-blend fund’s 7.7% gain but trailing the Russell 1000 Index’s 9.4%.”

—Ryan Jackson, analyst

iShares MSCI USA Quality Factor ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“IShares MSCI USA Quality Factor ETF features the market’s most profitable companies while minimizing exposure to firms with excessive debt. These traits are linked to market-beating returns and should support long-term outperformance. The fund tracks the MSCI USA Sector Neutral Quality Index. It seeks mid- and large-cap companies that exhibit high profitability, low leverage, and stable recent earnings growth. This fund successfully channels the quality factor, which helped the fund to a sturdy 13% annualized return from its benchmark change in September 2015 through December 2023.”

—Zachary Evens, analyst

SPDR Portfolio S&P 500 ETF

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 4 stars

“The investment seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P 500 Index. Compared to SPY, SPLG is cheaper with a 0.02% fee compared with SPY’s 0.09% fee. Over a 10-year period, this share class outperformed the category’s average return by 2.2 percentage points annualized. And it exceeded the return of the category benchmark, the Russell 1000 Index, by an annualized 16 basis points over the same period.”

—Morningstar Manager Research

SPDR S&P 500 ETF Trust

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“SPDR S&P 500 ETF Trust, the first-ever exchange-traded fund listed in the United States, combines a broadly diversified portfolio of U.S. large-cap stocks with low turnover and a low price. The strategy replicates the flagship S&P 500, a market-cap-weighted basket of about 500 of the largest U.S. stocks.”

Vanguard Mega Cap ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“Vanguard Mega Cap constructs a low-turnover, market-cap-weighted portfolio of the largest U.S. stocks at a low cost. The fund tracks the CRSP US Mega Cap Index, which pulls in stocks constituting the top 70% of the U.S. market and weights them by their float-adjusted market cap. The fund’s mega-cap orientation means that the fund will lag when smaller stocks rally. However, the stocks in this portfolio usually come with sound financial footing and are leaders in their industry, which can limit the risk of underperformance.”

Vanguard S&P 500 ETF

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

“Vanguard S&P 500 Index offers a broadly diversified, low-turnover portfolio of U.S. large-cap stocks at a minuscule price, giving it a durable edge over its Morningstar Category peers. Over the trailing 10 years through December 2022, the ETF share class has outperformed its average category peer by 1.89 percentage points. The fund should continue to outperform in the long run.”

Top-Performing Large-Blend ETFs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)