Zoom CEO after IPO's big splash: 'We need to double down'

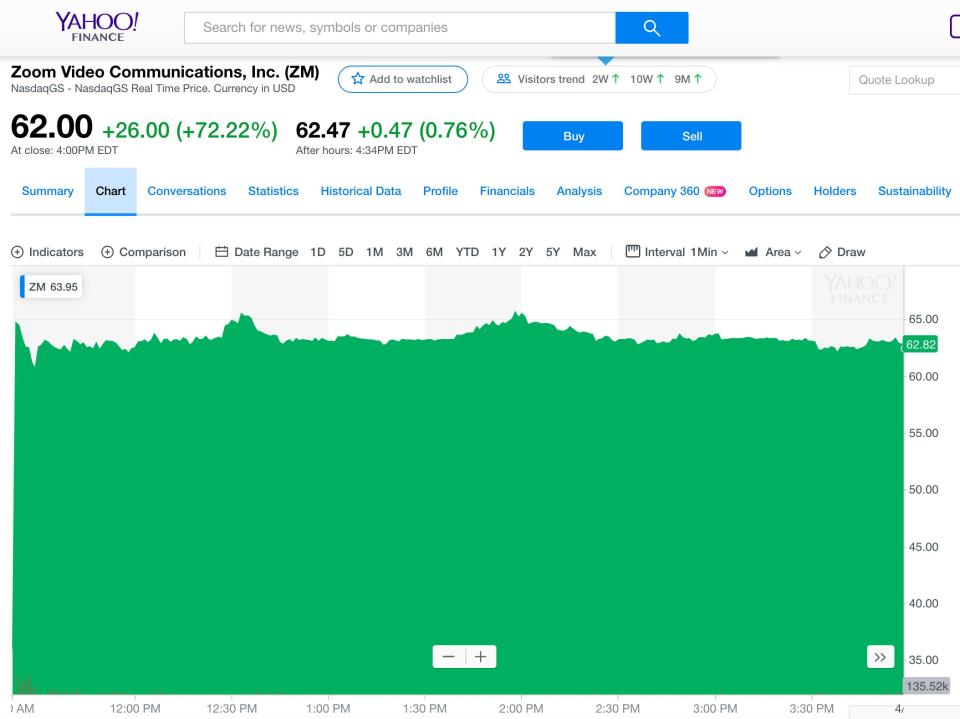

Zoom’s (ZM) highly-anticipated public market debut began on a high, with the stock jumping 72% on its first day of trading.

The company priced the initial public offering (IPO) at $36 per share and jumped to $65 as trading began on Thursday before settling at $62/share at market close.

The company describes itself as “the leader in modern enterprise video communications, with an easy, reliable cloud platform for video and audio conferencing, collaboration, chat, and webinars across mobile devices, desktops, telephones, and room systems.”

As all eyes watch the tech unicorn’s growth, which is now valued at more than $15 billion, Zoom Founder and CEO Eric Yuan has a particular focus.

“To be a public company, it can really help our company brand,” Yuan told Yahoo Finance’s On The Move. “Ultimately we need to double down on our execution — do what we can to care [for] our customers.”

‘If I do not, I do not feel comfortable’

Already profitable, with $269.5 million gross profit in its latest fiscal year, The California-based company’s secret sauce seems to be its connection to the customers. Yuan said that regardless of growth, he will maintain a personal touch with his consumer base.

“Every day I make calls to the customers,” he said. “If I do not, I do not feel comfortable.”

For Yuan, to “double down” seems to mean focusing on user satisfaction rather than competitors.

“We do not focus on our competitors, and we do all we can to make sure our customers are happy,” he said, noting that there is plenty of space to roam because the “market opportunity is huge” in the $40 billion industry.

Yuan also attributed Zoom’s success to two elements: the software’s ability to “work correctly” when users need it and the company’s priority of customer satisfaction.

‘To leave money on the table is always a good thing’

Asked if the company left money on the table by placing the initial price at $36 per share, Yuan said that it was part of the plan.

“We leave money on the table because those are our business partners,” he said. “When you are trying to win, you also want your partners to win... Our business philosophy is always care about our partners...

“To leave money on the table is always a good thing — that’s our appreciation to our new investors, to our new shareholders.”

Taylor Locke is a Producer for Yahoo Finance.

READ MORE: Why the Zoom and Pinterest IPOs could reverse a relative decline in tech valuations

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.