Innovation Realized: Where do energy leaders predict their future is headed?

Global energy companies find themselves at a crossroads in the energy transition. The destination is ahead, but getting there is a challenge. At Innovation Realized 2019, Chief Officers responsible for Innovation, IT, Digital and Customers explored ways to make themselves relevant in the emerging energy ecosystem.

What happens if you put 30 top executives from the biggest global energy companies in a room to find out what they really think about the future of energy? That’s what EY did at Innovation Realized 2019 in Boston, USA, this April, as we sought to ‘solve the now; explore the next and imagine the beyond’.

So what are the largest power and utility and oil and gas companies really thinking?

Well, they all agree that our energy future, irrespective of market or geography, will be decentralized and distributed between 2040-2050. The transition will be fast and disruption is to be expected. Though different markets are following a similar trajectory towards the same decentralized and distributed destination, they are at different stages in their evolution. Some feel the consequences of transition more acutely than others.

Delegates at Innovation Realized came from Europe, North and South America, Oceania, Asia and the Middle East. All are experimenting with ways to make themselves relevant and successful within the emerging energy ecosystem and were keen to share experiences, frustrations, learning points, ideas and solutions.

Behind the wheel of e-mobility

What came out, loud and clear, is that e-mobility is where most energy companies are pitching their immediate destinies.

- Asked what is going to be the biggest game-changer in technology within the next 10 years, and the overwhelming response (32%) was electric vehicles (EVs).

- Asked what will be the biggest game-changing technology within the next 20 years, and the answer (35%) was hydrogen – another big nod to the future of e-mobility – with EVs also coming in at second place (20%).

- Asked which of their revenue streams will make the biggest contribution to EBITDA, EV-charging came out on top (24 %).

It is not surprising that energy leaders identify EVs (and everything that goes with them) as their biggest revenue-growth opportunity. “E-mobility will accelerate the electrification agenda,” said one delegate, “bringing additional load that will compensate for dwindling demand from elsewhere, while delivering societal gains.”

But, e-mobility is also where conventional power and utility companies perceive their biggest and most direct threat … from oil and gas providers, auto companies, telecommunication and Big Tech providers, as well as new market entrants. The global population is expected to hit 10 billion by 2050, with two-thirds living in urban environments. As cities continue to grow, upsurge in demand will create opportunities for energy companies to immerse themselves in alternative value pools – EV manufacturing, public and private charging solutions, batteries, fleet transitions, grid integrations and city planning – that contribute to the widening energy ecosystem.

It’s a giant leap from utility to integral cog in the e-mobility wheel. How on earth will energy companies compete with new entrants? EY’s Thierry Mortier says the disruptive potential of e-mobility will see natural competitors become allies and collaborators as they venture into new value pools and distance themselves, perhaps, from their core activities.

Funding, inevitably, will be a problem. Who pays for charging infrastructure? How will it be financed? And what about standardization and interoperability between different technologies and players? Questions like these led us into a discussion on collaboration, which delegates recognize as a prerequisite for progression. “We need to work together to solve the problems – we can’t do it alone,” commented one.

Putting the customer front of stage

For all the emphasis on internally focused priorities, like interoperability, standards and collaboration, energy companies recognize that the digital transformation ought to be more keenly focused on the end customer. Among some, a view that customers haven’t quite got the attention they deserve.

And it is not so much what customers want right now, but what they may want in the future that should top energy companies’ agendas. EY’s Mark Hirschey says it is important to come at challenges from the customer’s point of view. In particular, to better understand what will persuade them to engage with a new technology, switch supplier or use a commodity provider for something other than kilowatt hours of energy.

By making customers the number one priority, it helps to build trust, prioritize investments, innovate products and services and deliver the types of experiences that tomorrow’s customers expect.

Future-making

The pace of change is fast; the end destination is decided. But the road map, right now, is a little vague.

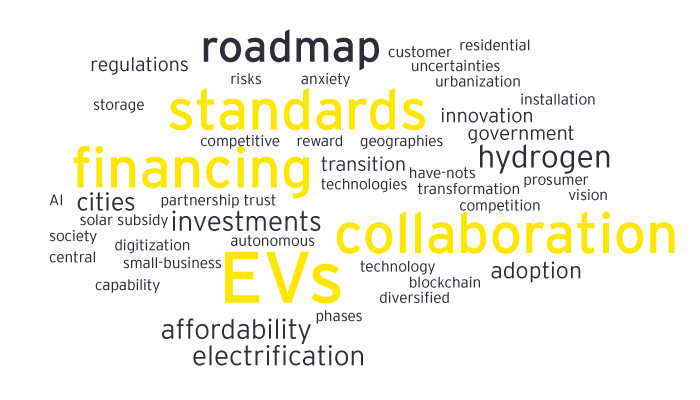

Many of the words that cropped up repeatedly at Innovation Realized focused on the challenges, like ‘risks’, ‘anxiety’, ‘uncertainties’ and ‘have-nots’. Fortunately, in looking toward their future, energy executives also offered a healthy dose of ‘reward’, ‘collaboration’, ‘vision’ and ‘trust’.

Global energy companies are preoccupied with how to make themselves relevant and win in the market. Success will come to those organizations that embrace flexibility, create their future rather than protect their past and anticipate change rather than wait for change to happen. E-mobility and customers are indicating the way.

Read my thoughts on NextWave Energy and join the conversation using @EY_PowerUtility / #EYEnergy.

HKMB Editor at Hong Kong Trade Development Council

4yOne key difference utilities will need to adapt to is the overlap between customer and supplier. Many customers will generate even more power than they consume. Many customers, which will include cars, will store and return power. Power utilities will start to resemble telcos, and the old power grid is likely to be completely replaced by a power network.

Managing Risk, one starfish at a time

4yBenoit Laclau —excellent forward thinking article. Global trends will advance at different paces depending on market pull, Government leadership and financing structures. The lines between Utilities and financial institutions will blur as will the bridge between technology and infrastructure. If a utility funds a smart road system that powers autonomous electric vehicles for which they provide power and administration—what are they?

Climate Influencer + advisor | Host, Award-winning #LivingChange #podcast | Talks about #cities #transportation #food | Bloomberg Green Champion 2024

4yLove this, Benoit:" What came out, loud and clear, is that e-mobility is where most energy companies are pitching their immediate destinies." And, this is why Sam Starr and I are co-founding a cycle logistics coalition for North America. #EVs are one exciting piece of electrifying everything, but there is a whole other layer of "electrification" getting much less coverage. It'd be fantastic for energy stakeholders to become a part of the eCargoBikes for last mile delivery potential too. Call them: LEVs (light electric vehicles).

Driving performance and engagement through goal-aligned strategy, revenue growth, and business evolution.

4yGreat article. I'm loving this intersection of Auto and P&U. Lots of changes needed in the Auto industry....it's going to be an amazing few years...

Growing old, knowing little about Future & Flexible Networks. AI is Fun. DER's Trouble. Havin Fun with Trouble!

4yGreat insights, as always! E-mobility is leading the way, big utility in Tx has already started planning for electrification of heavy duty vehicles and trucks which is considerably changing their grid planning but rewards are equally promising!