Staying Fit

Subscribe: Apple Podcasts | Google Play | Spotify | Stitcher | TuneIn

[00:00:00] Will Johnson: This week on AARP - The Perfect Scam.

[00:00:02] If it suited him, he would tell somebody that he was a law school graduate, which he wasn't, or he suggested to others that he had a wife and as far as I know, he didn't.

[00:00:12] Kenneth Hines: We trust people. That's what we do. We, we look for the good people, we look for things, we feel comfortable with that person, and we give them money.

[00:00:19] J.A. Jance: You low-down, lying scoundrel. What gave you the right to think you were entitled to other people's hard-earned money?

[00:00:28] Will Johnson: Welcome back to AARP - The Perfect Scam. This week we're going to tell you the story of a seemingly polished and successful businessman, a man who cozied up to hundreds of willing investors, only to lead them down a trail of financial ruin. Here to tell us about investment scams, often known as Ponzi schemes, is Gerri Walsh. She is the President of the FINRA Foundation, right?

[00:00:50] Gerri Walsh: Yes.

[00:00:51] Will Johnson: And Gerry you are my expert today, so normally we have Frank Abagnale here uh to give his insight and expertise on all the different scams we talk about, but you are uniquely positioned to give us insight into the world of Ponzi schemes.

[00:01:04] Gerri Walsh: That's right. We oversee the uh securities industry, the brokerage industry, but we encounter a lot of scams along the way.

[00:01:11] Will Johnson: Tell us what that is, what that means real quickly.

[00:01:13] Gerri Walsh: FINRA oversees uh broker/dealers in the United States, so anybody that's selling stocks, bonds, mutual funds, any registered security has got to be licensed by FINRA, and we have a database actually that you can check to determine whether your broker is registered. It's one of the best ways to protect yourself against unfortunate mistakes.

[00:01:33] Will Johnson: So to help guide our listeners through this story that there's a lot of lingo, and securities is one that, you know, we hear every day. What does that actually mean?

[00:01:42] Gerri Walsh: A security, there's a legal definition for it, and I am a recovering lawyer, um, but basically, when you trust your money to somebody who, for compensation, is going to use their efforts to make a return for you, so a note, a promissory note um, that can be a security. Now we think of securities as stocks and bonds and mutual funds. Those are some of the most common, but there are other types of securities including variable annuity insurance contracts.

[00:02:15] Will Johnson: In order to understand Ponzi schemes, on, on the surface, it doesn't seem all that complicated. And I've, well I've come to learn, they used to confuse me, but now that I've done a few stories on scams and Ponzi schemes, I get it, you know, you get money from new investors to pay your old investors.

[00:02:31] Gerri Walsh: Right.

[00:02:31] Will Johnson: But the way in which people go about doing that and hiding that crime, if you will, uh does get complicated. Am I right?

[00:02:40] Gerri Walsh: Very few fraudsters will say, I'm going to really just take your money. I'm going to run with this money, um, give it to me and I'm going to put it into a private jet. Nobody says that, nobody does that.

[00:02:51] Will Johnson: It wouldn't work.

[00:02:52] Gerri Walsh: No, it wouldn't, well hopefully it wouldn't work.

[00:02:53] Will Johnson: A terrible fraud.

[00:02:54] Gerri Walsh: You'd be a terrible fraudster if that, that's the way that you were doing it.

[00:02:58] Will Johnson: Why are they so successful, it's because the people are really good at pitching these investments?

[00:03:04] Gerri Walsh: That's a big part of it. And it's because the people that invest in them want to believe that these investments are real. And any con that's worth his salt will make the deal sound both real and true, um, so the old adage of if it sounds too good to be true it probably is, that's really tough advice for investors to take. Um, but what the con will often do at the outset is say, this is a long-term investment, uh it will take some time to get your money, and so your expectations are managed. Another tactic that the cons use is they will give tiny little bits of money, you will invest $100,000 and they might give you a monthly check of 50 bucks or 100 dollars or something like that, so that you believe that the investment is real, that it's paying off.

[00:04:00] Will Johnson: Is that like a dividend that you'd be getting?

[00:04:01] Gerri Walsh: Exactly. It's like a dividend, or it might be couched as some kind of interest payment, or some other form of payment, but when you're getting that regular stream of income, it makes you believe that the investment is real, because it's paying off.

[00:04:15] Will Johnson: And let me ask you, the term Ponzi, that's actually named after a name, somebody's name, right?

[00:04:19] Gerri Walsh: Charles Ponzi.

[00:04:20] Will Johnson: Okay, right. Like in the '30s or '40s, am I right?

[00:04:21] Gerri Walsh: In the '30s or '40s in Boston, he had this idea that he could make a profit selling some sort of postal stamp or some sort of coupon that the postal service was offering, and people were lining up in the streets of Boston to buy these coupons, but he was taking the money and uh, you know, he would sometimes pay the early stage investors a, a little bit of money for the bigger bit of money that they had given, uh but he kept on getting more investors. One of the things that happens with these schemes is that when one person starts getting that little payment, that periodic payment, they start believing that the scheme is real. Because somebody they know is making money on it, and they bring in more people.

[00:05:07] Will Johnson: So it's all about like this, this, these circles of trust that, if you will.

[00:05:11] Gerri Walsh: Right, but what ultimately is happening is you're robbing Peter to pay Paul. And at some point, it has to collapse.

[00:05:18] Will Johnson: All right, well Gerri, we'll come back to you to talk more about Ponzi schemes and investment scams, but let's get into this week's story about a Ponzi scheme that was taking place even as Bernie Madoff was getting busted for scamming millions from investors. But while Madoff is behind bars for his crimes, the scam mastermind in this story is, well you'll have to listen to find out.

(MUSIC SEGUE)

[00:05:38] Will Johnson: In order to understand a criminal mind, we often look into their past. What made them who they are? What forces in their childhood led them astray? This week we're going to tell you the story of Darren Berg, a man who conned hundreds of people out of millions of dollars in a massive Ponzi scheme, the largest in the history of Washington State. Perhaps Darren Berg's past started at a young age with an active imagination.

[00:06:02] Ciara O'Rourke: He created these vivid imaginary worlds where he ran a bus company, where he was a character that he invented named Rod Taylor who was this smart, invincible man, who never failed, who was admired, who was respected.

[00:06:18] Will Johnson: That's Ciara O'Rourke, a writer now living in Austin, TX. But it was in Seattle that she got to know all about Darren Berg's past while working on a story for Seattle Met Magazine in 2018. The imaginary person she is describing might give us some glimpse into the mind of Darren Berg and what drove him to do what he did.

[00:06:36] Ciara O'Rourke: In some ways, that's the persona that he adopted as he became Darren Berg, uh the founder of the Meridian Group, and the man who defrauded hundreds of people.

[00:06:47] Will Johnson: A lot of kids have active imaginations, maybe even an imaginary persona, but Darren Berg's real life persona was magnetic. Perhaps culled from his youthful daydreams, but then carefully crafted over the years and into adulthood, Berg was able to convince savvy investors that his company, The Meridian Group, was the real deal, and a worthwhile investment strategy, a place where aging retirees would be willing to put their lifelong earnings, their 401Ks, their nest eggs. It turned out to be a total fraud.

[00:07:16] J.A. Jance: The people who were really devastated were the ones who had already taken distributions; people who had already retired and who were being paid their, what they felt was their retirement income, except the bankruptcy court came around and did callbacks on all those distributed funds. So those people lost everything. Some of them lost their homes, some of them had to go back to work in their 80s, and for them, it was just, it was a disaster. It was less of a disaster for us because I was still working.

[00:07:55] Will Johnson: That's J.A. Jance, she's a best-selling mystery writer who turned her experience with Darren Berg into one of her novels. The book is called "Clawback" and the term clawback is actually a real one; it means a proceeding where a trustee seeks to recover or claw back funds paid to innocent investors in a Ponzi scheme. Talking to Jance today, it's obvious and understandable, she's still seething about the money she invested in Berg's company.

[00:08:20] J.A. Jance: We lost a cool half million. Of the 500,000 we recouped, 35,000.

[00:08:25] Will Johnson: From all accounts Darren Berg is a really likeable guy, and when you're making a living on a Ponzi scheme, likeability matters. You might even think of it as Berg's secret weapon. Ciara O'Rourke.

[00:08:36] Ciara O'Rourke: I think that one of the things that was appealing about him is how he exhibited his intelligence. So some people in trying to impress somebody, they might use really lofty language, they might use these words that you wouldn't normally use in conversation. Darren, in, he, what Darren would do was he would explain things in a frank kind of basic manner that served to then win the trust of the people that he was talking to. That it wasn't some sort of magic trick or fancy operation, it was just really um, as he described it, meat and potatoes stuff that he was dealing with, and that he had built this company one loan at a time, and that there wasn't a lot of say Wall Street magic behind it, that he was you. He was somebody who was trying to help you and wanted the best for you, wanted your retirement savings to earn some more money for you, who wanted you to succeed as he had.

[00:09:42] Will Johnson: Even in the wake of the Bernie Madoff scandal, Berg was a rock of optimism. She describes a video of Berg standing at a conference table crowded with men and women, potential investors it appears.

[00:09:52] Ciara O'Rourke: He is just exuding confidence and competence. Um, at one point he said there's no shortage of bad news on the doorstep. It seemed to be a nod to what was happening to Madoff’s investors. Uh, but he reassured the people that were there. It was March 2009, and it was in Meridian's office in downtown Seattle, and he said, quote, "There's no magic here. You might think it's magic, but it's actually real meat and potatoes stuff." And he field their questions and he sounded competent and smooth doing it, and he told them that they didn't need to worry about their money, that he had been building this company for years, and he'd been doing it honestly.

[00:10:33] Will Johnson: You might say he was the kind of guy you could sit down and have a beer with, the kind of guy you'd be willing to trust with your retirement savings.

[00:10:39] Hello!

[00:10:40] Will Johnson: Hey, Kenneth, this is Will Johnson at AARP. How are you?

[00:10:43] Kenneth: Good, how are you doing today?

[00:10:44] Will Johnson: Kenneth Hines is now retired, but he got to know Berg's reputation back in 2010, things were starting to fall apart. Hines was the IRS Special Agent in Seattle overseeing the case.

[00:10:54] Kenneth Hines: You talk with some of the people that were his victims and some of the people who were his business associates in the past; they said he was a likable guy, right? He's really likeable, he's outgoing, he warms up to you and warm up to him very easy, and that's what leads people to start, you know, just believing everything, and start believing things are going, going right. Uh, in investment fraud cases, that's what you see. You see that level of trust being built and they prey on that trust, whether it's through friendships, associations, um, or uh, you know, religious organizations where they'll use that hook to get into people and try to take their money from them.

[00:11:32] Will Johnson: And he was also able, I mean he had this investment firm or company or whatever you want to call it, but he, he was convincing other financial advisors to then talk to their clients right, and then say hey, you know, you should invest in, in what this guy has, has going on.

[00:11:45] Kenneth Hines: Yeah, 'cause he had, he had a so-called proven track record because uh, he showed the investors would invest this and this was their rate of return, they're getting their investment uh, uh checks, they're getting their interest checks, they're getting their money back but that money's not real money, it's money coming in from other, other victims. And he even, he even was able to pull off even one step further in just a churn and burn type of Ponzi scheme where you just getting people real fast and then move; this was going on for like 10 years, so he survived audits done by professional organizations.

[00:12:20] Will Johnson: The writer, J.A. Jance never met Berg, but she didn't have to. She and her husband were steered to Meridian by an advisor who had already been convinced.

[00:12:29] J.A. Jance: A number of years ago, my husband and I were advised by our, what we like to refer to now as our "wealth mismanagement company." They suggested that we become involved in one of the three real estate investment funds run by a scoundrel named Darren Berg.

[00:12:50] Will Johnson: But long before Berg was painting rosy investment pictures and conning people out of retirement nest eggs, he was figuring out ways to make easy money, if you want to call it that. Ciara O'Rourke recalls a story about Berg when he was still in college. Newly elected as treasurer of his University of Oregon fraternity.

[00:13:07] Ciara O'Rourke: And at that point, he seemed as winning as he did to um, investors in the (inaudible). So an alumni investor to the fraternity at the time called him a ball on fire. Uh, and in college, he had his own charter bus company already, and so part of his job at the fraternity was to collect rent from his frat brothers, but what happened was that he wasn't turning that money over to the landlord; he was using it for his bus company. He'd taken as much as $21,000 is what's alleged, but he was just righteous in denying the accusation, and he uh made some grand claims saying that he welcomed an audit and that investigators would find everything he did, he did for a reason.

[00:13:59] Will Johnson: Charges were not pursued, and he left the fraternity making his way to Portland where he ran into more trouble in the late '80s.

[00:14:05] Ciara O'Rourke: Was accused and convicted of bank fraud in the District of Oregon for stealing approximately $30,000 in a check kiting scheme, and then went on to Seattle where that didn't seem to stick to him, and he was able to found The Meridian Group, and build the Ponzi empire that he did.

[00:14:25] Will Johnson: But investing wasn't Berg's only game. The bus company that he dreamed about as a kid and then started up in college later became a reality.

[00:14:31] Ciara O'Rourke: Darren Berg, the man, grew up to then have a bus company that he doted on, that he uh kept immaculate, that he outfitted his drivers in nice clothes, he ferried the Seattle Seahawks around, he had big names. It was sort of um, a jewel in his uh portfolio. And he used 32 million dollars of investors' money on that bus company. Um, more than 11 million went to the construction company that he owned called Meridian Greenfield, and also to his Mercer Island home where he lived. It was a waterfront mansion, um, where he customized much of it. He spent millions on private jets and yachts, cars, and then this bus company, this floundering bus company really that I understand wasn't profitable.

[00:15:21] Will Johnson: But let's take a step back. If you're not totally clear on how a Ponzi scheme works, it's not all that complicated. Kenneth Hines explains.

[00:15:28] Kenneth Hines: Yeah, as long as new investors are coming in, the first ones in the investment pool will get their so-called return, or their interest, and as, as long as new people are coming in, and new victims are being duped into being part of the Ponzi scheme, the Ponzi scheme continues to go. It's just when you run out of new victims to take money from, that it all unravels.

[00:15:50] Will Johnson: Ciara O'Rourke describes in more detail how Berg's investment scam was set up.

[00:15:54] Ciara O'Rourke: He created and operated a series of investment funds. So what investors thought that he was doing with their money was buying real estate, mortgage-backed securities, and seller-financed real estate contracts or private mortgages. And so the people who invested with him, many of them were older and they had retirement money that they wanted to um, to do well. So, through summer of 2010, he had raised about 350 million from investors, in more than 20 states in the United States.

[00:16:26] Will Johnson: Darren Berg was particularly good at bringing in new investors. In addition to a lethal mix of charm and deception, he was also pretty good at covering up his tracks.

[00:16:35] Ciara O'Rourke: Money just moved so quickly between all of these different operations that Berg had going, so there was the money that was spent on MTR Western, the bus company, there was the money that was spent on the construction company. Ultimately um, Darren was not using the money the way he said that he was. And in one case, early on, before all of this happened, Moss Adams was auditing Berg's funds, because it wanted to confirm borrower's identities by mailing loan confirmation letters to them, but the problem was that these borrowers didn't exist. Darren had invented them. So what he did was he opened dozens of private P.O. boxes and he used fake names and listed the addresses on fake loan files, and the forwarded anything that was sent to those boxes to an address in Seattle, and what he did then was he completed the confirmations by himself and mailed them back to the auditor.

[00:17:26] Will Johnson: Kenneth Hines explains further.

[00:17:27] Kenneth Hines: So he set up phony mailboxes, so when they sent out verification letters to the so-called mortgage-backed security or whatever it was that he was supposedly investing money in, they would send out letters to verify the existence of that investment. He'd set up a P.O. box in that, that name, the letter would go there, it was re--, redirected to an address he controlled, he would fill it out and send it back to the uh, their accounting firm. So they would believe that all this was real. He did from A to Z on this, he did everything.

[00:18:00] Will Johnson: So let me get that straight. The phony mailboxes were proof of what exactly for an auditing firm.

[00:18:08] Kenneth Hines: If you're the auditing firm and they list an asset on the books, right? This is an asset, we have this much money invested into this asset and its rate of return is this. So what you do is you send a letter, a verification letter to that so-called asset or the people or the firm holding that asset as the investment.

[00:18:27] Will Johnson: And the asset could be like a mutual fund.

[00:18:29] Kenneth Hines: Mutual fund, another brokerage firm, uh, you know anything. That suppose he has ownership of that, so you send a letter of verification to it, and when the letter arrives the people are supposed to fill out and say, yes, this is how much we have in the fund, this is how much investors are getting. It's a lot of series of questions, and then they mail that back to the firm that's doing the audit. But the thing was, there was no firm. It was mailed to the so-called address and then that was forwarded to Berg, he'd fill it out, send it back to the firm, and they would be you know, none the wiser, that this was just all smoke and mirrors.

(MUSIC SEGUE)

[00:19:05] Will Johnson: But to understand Darren Berg, the future bus company owner and Ponzi scheme mastermind, we can again look to the past. What formed the man he would become?

[00:19:14] Ciara O'Rourke: He was the youngest of three siblings. And as a kid, he was really obedient. He was then outgoing as well. He was industrious. He um, would ride his bike to his neighbor's homes to take care of their dogs. He would sell cherries from him grandfather's yard, uh but his dad thought that he was um, weak, considered him a sissy, and uh, the father of um, Darren who then went by Frederick Darren Moskov, um, could be violent when he drank too much, and he would beat the older sons and then they then took it out on Darren.

[00:19:56] Will Johnson: Perhaps Berg turned to his imagination to escape some of the harsher realities of his childhood, and from that imagination emerged a polished savvy adult. Someone you'd be willing to trust with your nest egg.

[00:20:08] Ciara O'Rourke: He was extremely charismatic. He was always beautifully dressed and um, nice clothing. He was good looking. He uh was smooth and likeable and reassuring. He was able to win over the trust of people and to um, enable them to really sink uh, their faith and their money into him. They trusted him implicitly. He seemed very bright. He was almost glib.

[00:20:40] Kenneth Hines: It's like a, it's like a movie set, right. You watch a TV show or a movie, and somebody's in a city or they're in a town, but they're not actually shooting down in the city, they're on a set, a set in Hollywood; all you have is the facade, right? Behind the walls there's nothing. That's exactly what this was. Behind the paper, there was nothing. He set up phony uh, you know prospectuses, he set up phony annual reports, he just dummied all this stuff up and sent it out.

[00:21:05] Will Johnson: But behind the scenes, some of Berg's employees were seeing a darker side of their boss.

[00:21:09] Ciara O'Rourke: While Darren Berg had this very polished um, charismatic, public persona, in the confines of his office he could be angry, he was known to throw things across the room, um, he kept people on edge, that they were always felt, often felt like they were walking on eggshells, the people that I spoke to. Um, and one former employee told me that Darren kept people in silos, so everyone had to communicate to him. It was always um, A to B or B to C. It was never A to Z, and that he could see Darren tailoring his personality to each individual he talked to, sizing them up, and then deciding what he needed to do.

[00:22:01] Will Johnson: But even the best of plans backed by the most trustworthy seeming planners can fall apart. In 2010 Berg's scheme started to crumble. First one, then another investor, and then others questioned Berg's business and asked for their money back.

[00:22:14] Ciara O'Rourke: A big investor was scared, I mean Berg, had he talked to him or her, was not able to reassure this person. And heh couldn't pay the cash that this person wanted, so when news of that hit the media, one other investor, Ron Neubauer realized that Berg had probably also defrauded him. He had been reassured by Berg that nothing was wrong, but he was starting to suspect that things were a mess.

[00:22:43] Will Johnson: This particular investor was in fact a former Assistant US Attorney who prosecuted people like Berg in his own career.

[00:22:50] Ciara O'Rourke: He was convinced that this was a trustworthy person. To this day he still thinks that Berg was the most convincing person that he's ever invested with, and then Mr. Neubauer then went to an attorney and then initiated other actions against Berg to try and recover what money was available.

[00:23:09] Kenneth Hines: There was this couple of different funds, uh started filing lawsuits, and uh, which uh, tend to force the company into bankruptcy, and then forced him into personal bankruptcy.

[00:23:20] Will Johnson: So funds that filed bank--, that filed lawsuits, not individuals who are investing.

[00:23:24] Kenneth Hines: It would be, uh, it would be individual investors getting together and file.

[00:23:27] Will Johnson: Facing lawsuits and bankruptcy, Berg feels the wagons circling around him.

[00:23:31] Ciara O'Rourke: One day, Mark Calvert shows up, so he's been appointed to this case on behalf of the federal government, and he tries to get into the office, ultimately Berg lets him in, but first says, "No, you can't come in here." Then Calvert shows him that he has a court order and uh gains access to The Meridian Group and to some, but not all, of the financial documents that uh, are tied to all of Berg's financial transactions.

[00:23:59] Will Johnson: But Berg plays the role of a guy who's just made a few mistakes and wants to help the government out.

[00:24:04] Kenneth Hines: Mr. Berg went into the US Attorney's Office with the aid of his attorney to kind of you know tell his side of the story.

[00:24:10] Will Johnson: But initially his lawyer comes in and correct me if I'm wrong, but again it seemed like he was sort of saying, oh, hey, this is legit and I want to help out and figure out what, what's going on here?

[00:24:21] Kenneth Hines: Well it was more like come in before they come get me type of thing.

[00:24:24] Will Johnson: Yeah.

[00:24:25] Kenneth Himes: If I can be very blunt. You know it just, if you, you look at other things that he's had in his, in his past, where he always had an excuse for everything, and this was kind of an excuse too, oh all was good and going until things started going bad, and then I tried to use this investor's money to make right with the earlier one.

[00:24:43] Ciara O'Rourke: Initially, Berg is acting like he's cooperating with Mark Calvert, and um, trying to help the federal investigation, and sort of aw sucks-ing his way through this to what extent he could. He is um, he's acting as if, sure, maybe he's made some missteps, but let's try to untangle this together.

[00:25:07] Will Johnson: But Berg is playing games, and he's trying to cover his tracks.

[00:25:10] Ciara O'Rourke: He is using that guise to then continue, to continue to um, sell of his assets to put that money away. At one point he's accused of trying to set up an offshore account and funnel some of his money there.

[00:25:24] Will Johnson: Darren Berg is hoping to stay a few steps ahead and funnel cash where he hoped it wouldn't be noticed. But as bankruptcy proceedings get underway, it's pretty hard for investigators and the federal government not to notice the fortune that Darren Berg had amassed over time.

[00:25:38] Ciara O'Rourke: He had his place in Seattle. He had another home in a Magnolia neighborhood in Seattle that initially authorities weren't aware of. He had purchased a house for his mother in Oregon where she lived, and that's where he grew up. Um, a consultant working for the trustee discovered a new bank account in October 2010 that was in Berg's name and he had opened it more than a month earlier, but he didn't disclose that to law enforcement, and he didn't mention it when he was asked to list all of the bank accounts that he continued to control. So that continued to feed his suspicions, that he was not just not cooperating, as he was pretending to, but um, taking steps to protect himself and inoculate himself from the blowout that was to come.

[00:26:22] Will Johnson: But Kenneth Hines and federal agents are on the case at this point and following the money.

[00:26:26] Will Johnson: And how do you do that? I mean without getting, I mean way into it, way into the weeds on it, what, what do you have to do?

[00:26:32] Kenneth Hines: Well you, you want to start tracking, uh, you start from the beginning sometimes. You look at different things. You go out and talk to an investor. What did you, how did you, did you wire the money? Did you send a check? And then what you do is you start tracking that check or that wire transfer, the one account it went into. And then from there you go to what account did that go to? Where did that, so you start looking all of the inflows and outflows of the money. You just, and you just painstakingly check it, so you figure there was 180 million dollars in this or so, uh, so the agents tracked or tried to track all the money. And it becomes a very painstaking process looking through bank records, looking through financial statements, just tracking things. Again, when you've got someone preparing fraudulent documents or fraudulent uh financial statements or annual report, that gets more complicated, right, because now which ones do you look at, and which ones do you verify? Well really when it comes down to tracking uh, an investment fraud case or Ponzi schemes such as this, you track the flow of the money. You look at the paperwork, that's a good road map, but it's not, it's not the foundation of the road map. The foundation of the road map is actually tracking the money.

[00:27:37] Will Johnson: As investigators follow the money, they then uncover more of Darren Berg's financial empire, and not just fancy houses and bank accounts.

[00:27:45] Kenneth Hines: They followed the money, the agents followed the money uh very thoroughly, and they posed that you know, you buy two yachts, you buy two jets, you buy a fancy house, you remodel the fancy house, you buy expensive cars, that money's got to come from somewhere, and in this case, it came from investors.

[00:28:00] Will Johnson: So he, and he was actually buying all those, all those things that you mentioned?

[00:28:05] Kenneth Hines: Yeah. Yeah.

[00:28:06] Will Johnson: I mean that's, he wasn't hiding his, his profits. He was living high on the hog.

[00:28:11] Kenneth Hines: Well that's, that's what some of the people that invested in him and some of the employees said that, you know, he, it looked like he was doing really well.

[00:28:17] Will Johnson: Yeah.

[00:28:18] Kenneth Hines: He was, he was playing a role.

[00:28:20] Will Johnson: The court appointed attorney, Mark Calvert decides to let Berg's investors know what's going on. For many of them, it's the first time they would learn what happened to their money.

[00:28:28] Ciara O'Rourke: Mark Calvert got together more than 500 investors for a meeting, and at that point revealed that they, that he thought that they had invested in a Ponzi scheme. And for some of these folks, that was news to them. They were not among the investors who had initiated bankruptcy filings, um, but people who uh, in some case had invested retirement money, and uh were not seeking to cash that out, so that they were maybe more detached than some of these people that were keeping an eye on what was happening. And at that point, Calvert told them that um, there were some funds that appeared to be lawful, but that Berg had been making unauthorized loans from the funds that they had invested into him, and he was using that money to pay for interest payments and MTR Western, the bus company, the subsidiary bus companies, and his lifestyle, spending it on his home, on lavish parties, on hiring musicians to come and perform at these parties, clothing, travel, transportation.

[00:29:33] Will Johnson: The victims of Berg's greed tell a story of trust and then deception that Kenneth Hines has sadly heard before.

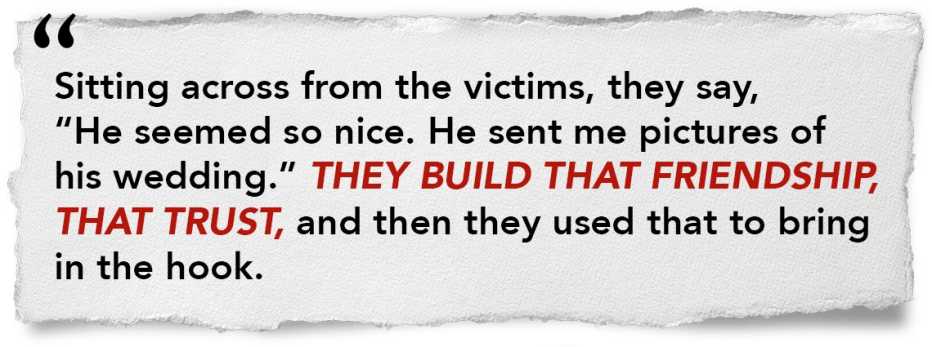

[00:29:40] Kenneth Hines: I work a lot of investment fraud cases as a field agent, and sitting across from the victims, they, they tell that story. They say, oh, he seemed so nice, uh sent me pictures of his wedding, just, you just name it, it sounds like there was a friendship more than an investor/investment uh type relationship. It was more of a, they built that friendship, that trust, and then they used that to, to bring in the hook.

[00:30:03] Will Johnson: Kind of makes you shake your head to think about the type of person that can do such a thing where it's not just, you know, some random crime, where you're robbing somebody of their money, but you're actually burrowing into their, their life, their family, and taking advantage of a, of a quote unquote friendship.

[00:30:20] Will Johnson: I, I think that type of fraud like this where people not only are investing their money, they invest in the person as well. So not only the money has gone, which is devastating, and you, you've been in this investigation and other ones you see, it's just devastating financially for some people that will never recover from this, uh, and then you see how they feel emotionally uh victimized as well. So you have the financial aspect of it, which is devastating as well, but then you have the uh emotional part where people start to think, how could I have been so gullible, and they start blaming themselves to an extent. The money's one thing, but then it's the emotional impact that you see in some, some of the people, uh where they, some go to counseling. They have to deal with it. It's almost like post-traumatic stress on some of these things.

[00:31:08] Will Johnson: This case is no different. Darren Berg's victims lost a fortune; for some, a lifetime of savings.

[00:31:14] Kenneth Hines: Sitting across the table or sitting in someone's living room and having them tell you the story of what happened to them, you just see it just deteriorating, it's like, okay, you see the buildup of the friendship, and then you see it, the collapse and the, the, the confidence of them to even make basic decisions later on about friendships. Uh, yeah, it was, it was heart--, it was heart wrenching for me when I would go out and talk to these people.

[00:31:39] Will Johnson: Darren Berg probably saw the writing on the wall at this point. His business is an open book to investigators, a complicated tangled book, but open nonetheless. The story of Darren Berg is far from over.

[00:31:54] Will Johnson: We are back with Gerri Walsh. She is President of the FINRA Foundation. She knows everything there is to know about Ponzi schemes or at least a lot. How, how common are they? I mean you hear about the big ones; we all know about Madoff; we're learning about Darren Berg and his scheme.

[00:32:07] Gerri Walsh: The truth is, we don't know how big the problem is. When it comes to financial generally, investment fraud specifically and this kind of investment fraud, but what we do see is that eventually the schemes unravel and it's typically when one or more of the investors seek to get their money back. And the money isn't there.

[00:32:29] Will Johnson: And then if, if you don't get caught, do you have to just get out of it and, and escape or you know leave, leave town?

[00:32:35] Gerri Walsh: I can't give advice to con artists.

[00:32:38] Will Johnson: I don't mean that, but I'm always interested in this Ponzi scheme and the idea of them, and then what, what the end game is, because I mean, it seems like there's not much of one. You can go for a while and make money, but somebody's going to get wise to it, hopefully.

[00:32:51] Gerri Walsh: The end game is that the, the fraudsters do close up shop and what they often do, like cockroaches, is move someplace else and open up shop under another name, they, they might falsify their, you know principals and run a completely different operation in a different state.

[00:33:09] Will Johnson: With this Darren Berg story, we have heard some of the stories and in other Ponzi schemes too of people who have uh, a limited maybe retirement fund or, or, or some, a certain amount of money that is maybe their nest egg. And the older you get, the harder that is to build back up, and it's really truly, tragic when you think about people having to go back to work, um, or who can't pay for a home, what have you.

[00:33:35] Gerri Walsh: And they often can't go back to work; sometimes they're at a point in their lives where it just isn't feasible.

[00:33:41] Will Johnson: Do you have experience, personal experience working with various Ponzi schemes or victims that you could share any stories of your own and, and what you've seen?

[00:33:50] Gerri Walsh: Well, so back in the early days of my being a lawyer, I worked at the Securities and Exchange Commission and there were a couple of frauds that we investigated, one of which was a Ponzi scheme, and it involved these international notes. It was called a high yield roll program, and the idea was that it was this super-secret type of investment and you know, only the top level bankers at top Wall Street banks new about it, and if you asked, if you hadn't been invited to participate in the investment, you would be told, oh no, it doesn't exist. Now how clever is that, right?

[00:34:25] Will Johnson: It seems like there's some secret fund or, or otherwise that, that you'd love to get in on.

[00:34:30] Gerri Walsh: Exactly, but the con is telling you the truth, that anybody that you ask who isn't part of it is going to tell you that it's not real. But yet they're creating this aura of this thing is really true, and you just put in a million dollars, um, or 100,000 dollars, you know, of course everybody is supposed to put in a million dollars, but for you, I'll make it 100K, and then within two years through this trading program that will roll the securities, whatever roll means, it's never described in the documents in language that any human being could...

[00:35:01] Will Johnson: That's a word that's used, roll?

[00:35:02] Gerri Walsh: Roll, like, like a sandwich roll. R-o-l-l. Um, but it never, it wasn't real. Um, but it sounded so good and it paid such high yields, and the idea that there was this exclusive offer that was only available to you, because you were special, that kind of ticks off a lot of the boxes on the persuasion tactics that cons use.

[00:35:25] Will Johnson: When you're looking to make an investment, a lot of us who are not experts like yourself or people that are int he field, I don't know, I kind of thing about it like going to the doctor, like you sort of trust and believe the doctor you're talking to, and that can be something that, that I, a dynamic that happens with a financial advisor where there's a lot of terminology, I mean it's a whole business that, that many of us are just not attuned to and understand.

[00:35:50] Gerri Walsh: Sure.

[00:35:52] Will Johnson: And so, I feel like that's one reason why it's easy for some folks for, for a lot of us to get convinced, and there's persuasive ways in which people convince you.

[00:36:02] Gerri Walsh: Absolutely, and any con that is trying to work their magic on you, they're not likely to get you to part with your money in the very first offering, right, and most of the fraud, I want to make sure your listeners understand, most of the fraud happens outside the realm of regulation. In other words, the people that are not registered as brokers or as advisors. Um, so one of the best ways to avoid fraud is simply to check, use Broker Check. It's on the FINRA website, really easy to do. But the persuasion tactics that these cons will use are, they'll dangle the promise of something that you want, like guaranteed returns, or untold riches. And they'll make it seem real. It's a, it's a tactic that's called phantom riches. They'll also use their authority, they'll pretend to be experts, and people believe experts, just like you were saying, people want to learn, they ask questions, someone [00:37:02] gives them the answers, you know, they seek out people who have fancy titles, um, and they look for people who seem to know their stuff, but that can be faked. There's also this sense of um, consensus, social consensus. If everybody in your faith group, in your, and well that's a, that's a common thing. The whole affinity marketing and affinity fraud where you target a particular group because you're all, you have some characteristic that you share; whether it's your gender or ethnicity or your profession or where you live, um, all those kinds of things can be used against you. And the thing is, we tend to not want to do our homework, right? Ultimately, we're all third graders...

[00:37:46] Will Johnson: We're busy, we've got other stuff going on, and it's hard to learn about investments.

[00:37:50] Gerri Walsh: Right, right, and if somebody you know and trust, not just the person who's pitching the deal, but your, your neighbor, your congregant, um, someone in your family, if they've already looked into the investment and think that it's good, you're less likely to do your own independent homework, but that's so critical to do.

[00:38:10] Will Johnson: So if you're, if they're registered with FINRA...

[00:38:13] Gerri Walsh: Correct.

[00:38:13] Will Johnson: As a registered broker.

[00:38:14] Gerri Walsh: As a registered broker, or if they're registered with the Securities and Exchange Commission, or with the state securities regulator as an investment advisor, um, that would be something that would show up on Broker Check, and it's super easy. BrokerCheck.org.

[00:38:28] Will Johnson: Gerri Walsh is President of the FINRA Foundation. We're going to have you back next week because we're going to tell the rest of the story of Darren Berg and what happens. And we're going to tap into some more of your expertise on Ponzi schemes and investments.

[00:38:39] Gerri Walsh: Fantastic.

[00:38:40] Will Johnson: For more information and resources on how to protect yourself or a loved one from becoming a victim of a scam, you can visit AARP.org/fraudwatchnetwork. As always, thanks to my team of scambusters, producers Julie Getz and Brook Ellis, our audio engineer, Julio Gonzales. And of course, my co-host Frank Abagnale. Be sure to find us on Apple podcast or wherever you listen to podcasts. For The Perfect Scam, I'm Will Johnson.

END OF TRANSCRIPT

It’s 2009 and Bernie Madoff has pleaded guilty to stock and securities fraud in New York. Covered heavily by the media, Madoff’s Ponzi scheme is front of mind for many Americans. It also has a group of investors on the West Coast concerned. They’ve placed their hard-earned savings with the Meridian Group, a company operating out of downtown Seattle. Its founder, Darren Berg, a well-known and respected businessman, reassures his investors that their retirement savings are safe. His firm has passed several audits, and Berg promises that there is no “magic” behind the company’s robust rate of returns. Besides Meridian, Berg runs a successful charter bus company with high-profile clients like Nike, the NFL and Google.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

People in Washington state trust Berg, and his charismatic personality has helped him assuage investors for years. But in 2010, the house of cards Berg had built begins to fall. One of Meridian’s largest investors wants to cash out, and Berg is unable to pay. Complaints roll in to the U.S. attorney for the Western District of Washington and the FBI. The authorities take a deeper look into the Meridian Group and confirm investors’ worst fears: They are part of the largest Ponzi scheme the state has ever seen. Darren Berg’s lavish lifestyle of yachts, mansions and private planes has been fraudulently funded by his investors. With the authorities working to shut the scheme down, the end of the Meridian Group is imminent, but Berg has one more trick up his sleeve.