The economy is still all about -- who else? -- Boomers

Paul Davidson

Paul Davidson

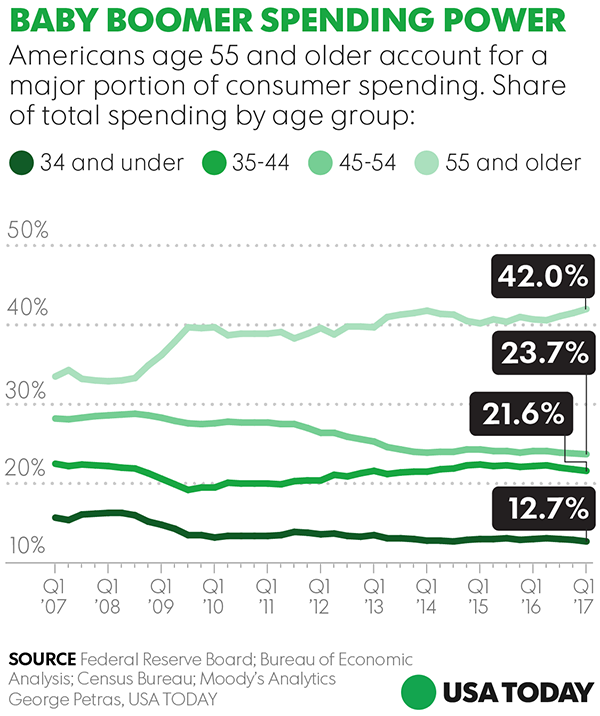

Hey advertisers! Take a break from fixating on Millennials and check this out: Baby Boomers and their elders are making up an outsize share of consumer spending.

The trend has significant implications not only for the biggest brands that are missing out on a lucrative audience but for an economy that continues to trudge along at a modest pace. It’s helping fuel a shift in household spending from retail goods to services, spurring more job growth but weaker worker output. And it’s contributing to the woes of retailers, such as Macy’s and Sears, that are closing hundreds of stores. The Commerce Department said Friday that retail sales unexpectedly fell in June.

“The 50-plus and 60-plus population is clearly playing a large role in consumer spending and older consumers are going to become more significant as these trends intensify,” says Wayne Best, chief economist of Visa.

In the first quarter, Americans 55 and older accounted for 41.6% of consumer spending, up from 41.2% late last year and 33.5% in early 2007, according to government and Moody’s data. Toss in 53- and 54-year-olds, and the Boomer- and-older set comprise about half of all consumption, according to Visa and Moody’s Analytics. In other words, they’re spending somewhat less than they did when they were younger but more than their predecessors.

Learn more: Best travel insurance

Advertisers, meanwhile, focus their campaigns almost exclusively on Millennials, says Marshal Cohen, chief industry analyst for the NPD Group, a consulting firm on consumer behavior and retail. “The fastest-growing segment is the Boomer consumer,” Cohen says."And they have a higher level of discretionary spending power." Marketers “still tend to put all their eggs in one basket.”

Social Security beneficiaries may get biggest raise in 6 years

In quest for Millennials, financial firms try to 'crack the code'

Millennials eat out more than any other generation

The big brands, he says, assume their Millennial-targeted ads will also move Boomers who aspire toward perennial youthfulness. But he says that misses the mark because older adults have different needs. Instead, he says, the companies should tailor separate campaigns to different age groups.

Boomers also have distinctive spending patterns. They’re buying fewer cars, shirts and TVs and shelling out more for services such as healthcare, travel and entertainment. Apparel purchases accounted for 2.7% of all spending for consumers age 55 to 64 in 2015, down from 3.6% for that age bracket in 2005 and 5.6% in 1995, Moody’s and Labor data show. Meanwhile, 8.7% of their outlays went to health care, up from 5.9% in 1997 and 5.7% was devoted to entertainment, up from 4.8%.

And consumers age 50-plus accounted for 57% of credit spending at hotels last year, according to Visa. Household spending overall makes up about 70% of economic activity.

Karen Ellers, 64, a retired information technology manager, drives an 11-year-old Nissan Altima and has scaled back her retail purchases. “I don’t need to spend money on business clothes, don’t need any more jewelry, don’t really need any new furniture,” says Ellers, who lives in Peachtree Corner, Ga.

But she’s spending “a lot more” on medical premiums. And while she’s still taking a couple of week long vacations each year to Las Vegas, she has added annual trips to places like Ottawa, Canada, as well as a few overnight stays at hotel casinos in North Carolina.

Her income from Social Security and a pension is less than a third of her former six-figure salary, but she has a sizable nest egg and her mortgage is paid off. “I have the time, I have the money,” she says. “My financial adviser told me to start spending it.”

Here’s why older adults are important to the economy:

There’s lots of them. The 90.7 million Americans 55 and older last year made up 28% of the population, according to the Census Bureau. In 2000, the 59.3 million people in that age group comprised 21% of all U.S. residents.

They’re working longer. Americans are healthier and living longer, allowing many to work into their 60s and 70s. That shift has been buttressed by the decline of physically demanding occupations in fields such as manufacturing and construction, and the spread of white-collar jobs requiring college degrees, says Mark Zandi, chief economist of Moody's Analytics. Many still enjoy their work and consider it a vital part of their identity, Visa's Best says.

At the same time, “Some are coming back into the workforce” after their nest eggs were hammered by the stock market and housing crashes of the late 2000s, Best says.

All told, 38.7% of all 55-and-older Americans are employed, a share that has risen steadily from 30% in 1997, according to the Labor Department and AARP. The median income of households headed by 65- to 74-year-olds increased to $47,432 in 2015 from $31,670 in 2005, far more sharply than the earnings of other age groups, Moody’s and government figures show.

They got lucky. Many Boomers entered the workforce during the robust economic expansions of the 1970s and 1980s, allowing them to land good first jobs and advance in their careers. And despite the stock sell-off in the Great Recession, they benefited from the long bull market of the 1980s and 1990s and the market’s recovery since 2009. In 2013, the latest Census data available, the median net worth of households headed by 55- to 64-year-olds, excluding home-equity, was $66,047, up from $51,026 in 2005.

Many Millennials, by contrast, struggled to get jobs out of high school and college or took positions for which they were overqualified during and after the economic downturn, setting back their career tracks and earnings.

They’re defying age precepts. “The Boomer consumer is not one to sit there and say, ‘I’m getting old and I’m going to slow down,’” NPD's Cohen says. “When people turn 65 they’re just starting to live life and they have a higher level of disposable spending power.”

The shift in consumer purchases from goods to services has helped keep average monthly job gains close to a healthy 200,000 despite tepid economic growth of about 2%. Service positions can’t be automated as easily as jobs at factories that make retail products. The country’s increasingly service-oriented economy is also less vulnerable to sharp swings since jobs in fields such as health care, law and finance are needed even in tough economic times, Zandi says.

Yet some Boomers are stepping up their spending on all fronts. Take Jim Gomes, 60, a finance executive, and his wife, Jennifer, a management consultant.Jim got a new job at Sony Pictures last year that boosted his pay about 20%. The couple, who live in Los Angeles, dine out several times a week, drive luxury cars, buy the latest electronics and take lavish vacations that included a Mediterranean cruise last year.

“We have a lot more disposable income than we had 10 years ago,” Jim says, adding that a heart attack four years ago altered his outlook. “We are trying to enjoy the time we have and not delay that gratification until a day that may never arrive.”